Recently, I sold my first affiliate website for a six-figure sum on Empire Flippers. I had initially listed it on Investors.club due to recommendations from experienced SEOs in the industry, such as Matt Diggity and others I know personally, as well as their lower commission rate of 5% compared to Empire Flippers’ 15%. However, my experience with Investors.club was a complete disaster from start to finish. In fact, they even failed when closing down my listing, which you’ll see why later.

Later, I tried Motion Invest as another option to sell my website. I want to share my experience with these three brokers, Empire Flippers, Motion Invest and Investors Club, to hopefully provide helpful information to first-time sellers.

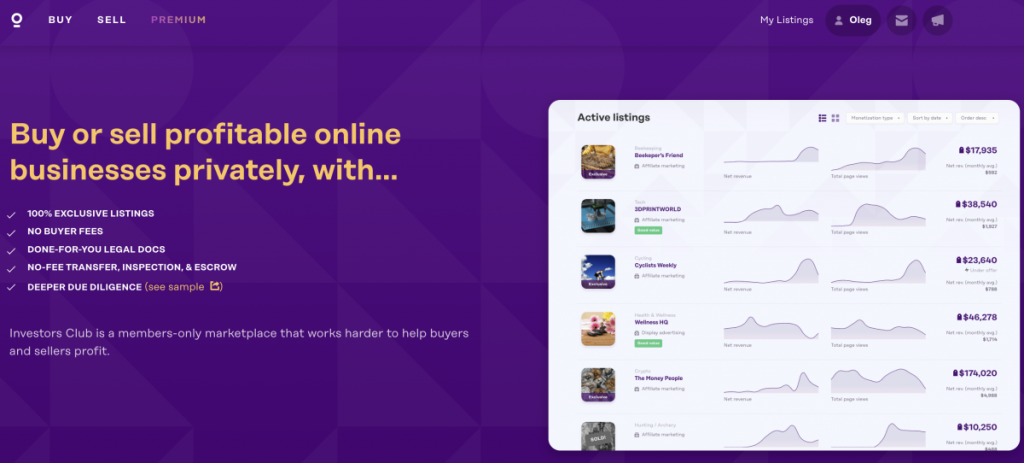

Investors Club

Initially, I had my website listed with Investors Club for nearly three months before switching to Motion Invest due to lack of activity. I asked around various SEO communities and received recommendations for Investors Club from multiple trusted sources, including friends and well-known SEO celebrities e.g. Matt Diggity. The lower commission rate of 5% compared to 15% on other platforms was also an appealing factor.

However, my experience with Investors.club was not good from start to finish.

Pros:

- No minimum monthly income requirements, making it easier to list smaller websites or businesses.

- Easygoing vetting process, which may be less intimidating for first-time sellers or those who are unfamiliar with the process.

- 5% commission is lower than other platforms, potentially saving sellers money on fees.

Cons:

- Extremely slow support: Getting a response from Investors Club’s support team can be frustratingly slow, making it difficult to get help when needed.

- Very unorganized process: The platform’s process for selling a website can be confusing and unorganized, making it challenging for sellers.

- Misleading information on the website: Some of the information on the Investors Club website can be misleading or inaccurate, leading to confusion for users.

- Lower number of potential buyers compared to other platforms reviewed in this article

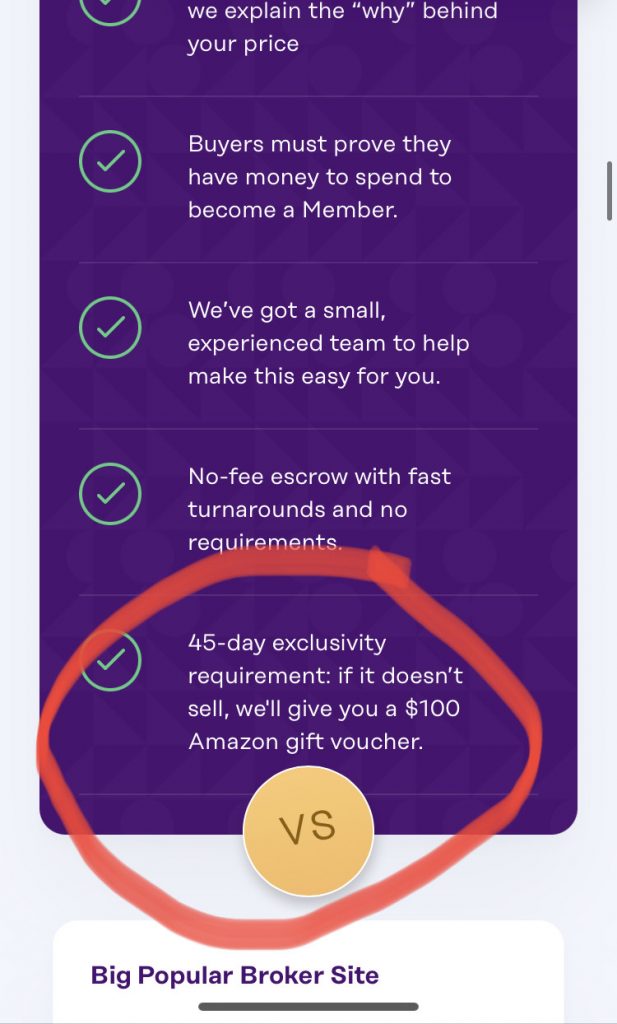

- Guaranteed sale or $100 Amazon gift card back after 45 days (read with Borat’s voice: NOOOOT)

Fail #1: Unable to Add Website to GA

At the beginning of the process, I needed to give Investors.club access to my Google Analytics, but I was unable to do so because they had reached the maximum number of accounts. I sent an email and received a prompt response from their team, which I appreciated. They fixed the issue the next day and I was able to continue filling out my website’s listing.

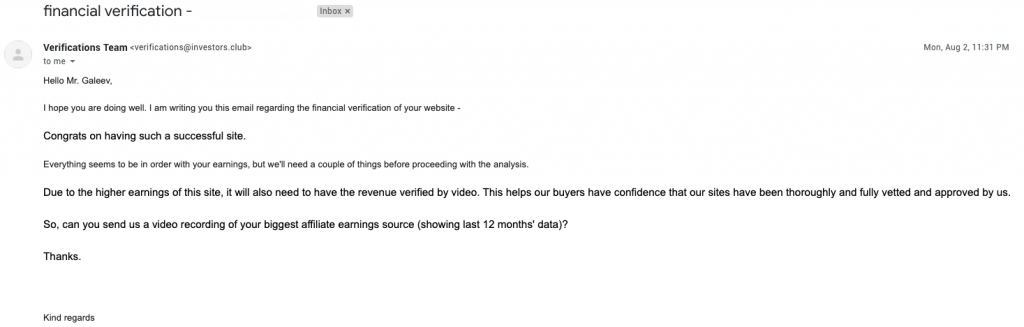

Fail #2: Unprofessional Emails

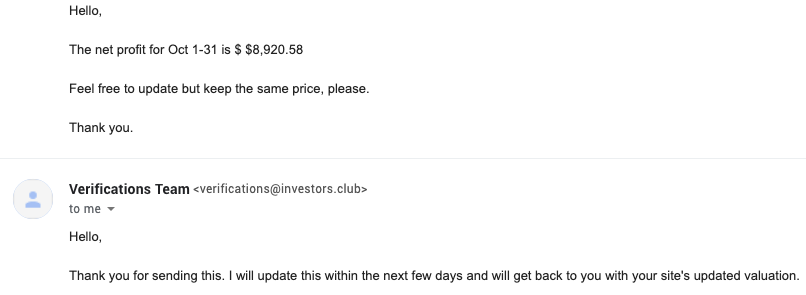

The entire communication process was conducted through verifications@investors.club. I had expected to communicate with an advisor or manager regarding my listing, but the emails I received were unprofessional in nature. Look at these:

The subject lines were not capitalized, the font was different, and there was no photo. Additionally, some emails were sent without a signature, making it unclear who I was communicating with as different people would reply under that email address.

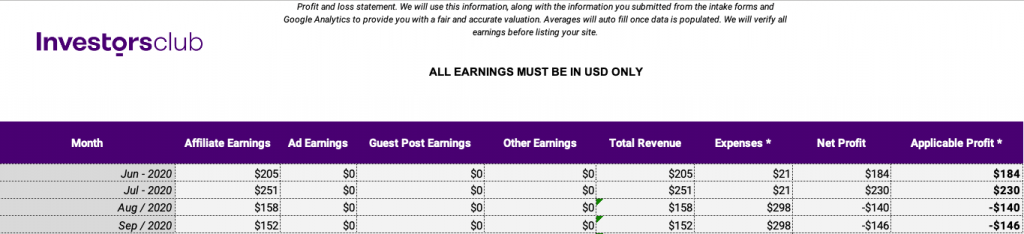

Fail #3: Easygoing Profit and loss statement process

While the ease of the P&L statement process on Investors.Club might seem like a positive aspect for sellers, it raises concerns about how the platform handles other important steps in the selling process, such as website migration and bank transfer. Attention to detail is crucial in any business transaction, and the lack of thoroughness in the P&L statement process gives me pause.

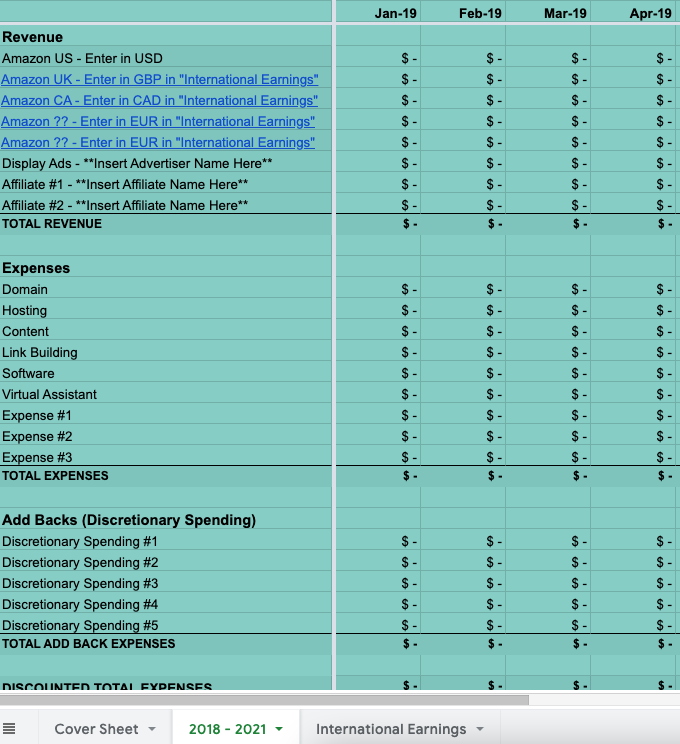

As a seller, you expect the P&L statement process to be rigorous and thorough, as it involves verifying all earnings and expenses from the past. While I appreciated that Investors.Club only required the past 12 months of financial information, I found their Excel sheet to be lacking in detail. As someone who keeps a more detailed P&L statement for my own purposes, I was surprised by the simplified format used by Investors.Club.

I have concerns about the P&L statement provided by Investors.Club, as it lacks a proper breakdown of earnings and expenses. For example, the category ‘Affiliate earnings’ does not specify which programs the earnings are from. While I can add up the numbers myself in Excel, I am also concerned about how to handle earnings in different currencies, such as USD, CAD, EUR, GBP and AUD. Additionally, the simplified format of the statement makes it easy for the numbers to be manipulated, which is worrisome.

While Investors.Club assures that each number will be carefully checked, I believe a more detailed and transparent breakdown of earnings and expenses would inspire greater confidence in the platform. This leads us to the next point…

Fail #4: Weird verification of P&L statement

I expected to provide all the screenshots from affiliate earnings and more detailed questions about the numbers. If I were a buyer, I would definitely have so many questions about such a P&L statement. However, it turned out to be easier than I thought – all they asked was for a video recording of my biggest affiliate earnings source over the last 12 months:

As someone with 11 different affiliate programs, I found this request to be somewhat arbitrary. I ended up showing them my top three earners, just to be safe. While this approach worked and they began their evaluation, I couldn’t help but wonder what would have happened if I had lied about the rest of my affiliate earnings. Overall, I found the P&L process on the Investors.Club platform to be somewhat lacking in transparency, which could potentially raise concerns for potential buyers.

Fail #5: EXTREMELY long evaluation (over 2 weeks)

I found the evaluation process on the Investors.Club platform to be a bit frustrating. There was no clarification on how long it would take to evaluate the website, even though I felt that it should be straightforward once they had verified my P&L and all the relevant information. I assumed that a 2-4 business day timeframe would be reasonable, so I followed up after 4 days for an update. However, the response I received was vague and disappointing: ‘We are still working on the website’s analysis and will let you know about the valuation as soon as we finish it.’ I was left wondering why they couldn’t provide a more specific time estimation.

After waiting for over 2 weeks with no update, I followed up again. Surprisingly, they responded the same day with the evaluation. I couldn’t help but wonder if my follow-up had prompted them to remember my website. When I asked how they evaluated my website, the explanation was brief: ‘We used an L3M average and the multiple is 36x.’ While this sounded simple, I still didn’t understand why it had taken over two weeks to complete.

Despite the frustration, I was able to negotiate and increase their evaluation by 5% and signed the agreement. However, even after signing the agreement, it took them a few more days to make the listing live.

Fail #6: Long updates

Every month, I had to provide an update to my P&L statement with the latest data. However, I was surprised to find that nobody even checked the numbers that I sent via email.

However, I was surprised to find that nobody even checked the numbers that I sent via email. While some people may find this process convenient, I felt that it lacked accountability and there was a possibility for human error. When dealing with 6-digit assets, I expected the platform to take more responsibility for ensuring accurate and up-to-date information.

Furthermore, once I sent the updates, I expected them to be processed and live on the platform as soon as possible. Unfortunately, there were instances where it took over 12 days for my updates to be reflected on the platform. This delay was frustrating.

I also had a negative experience when trying to decrease the price of my listing. Despite requesting the change, it took almost a week for them to apply it to the listing. This slow response time added unnecessary stress and further highlighted the inefficiencies of the platform

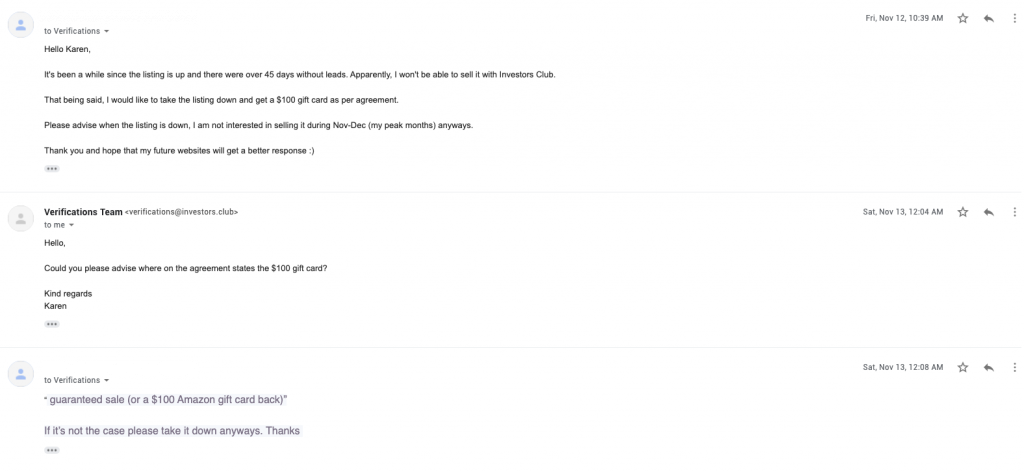

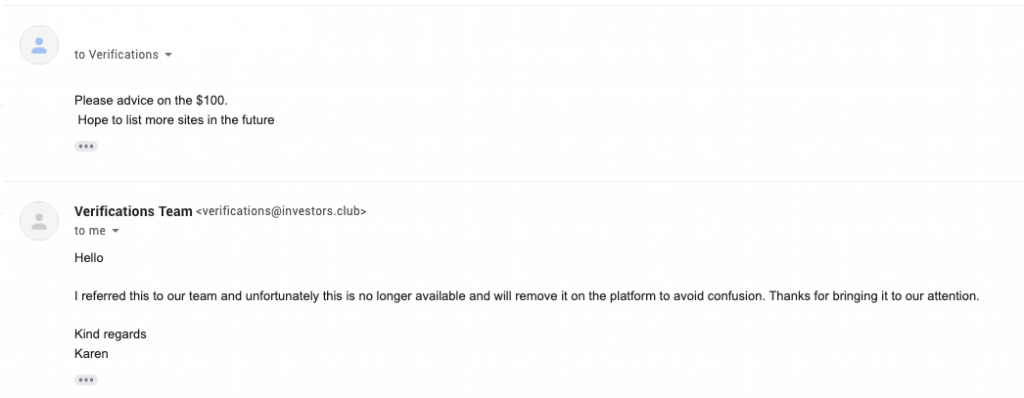

Fail #7: Taking down the listing

My final complaint about the Investors.Club platform was related to the process of taking down my listing. After almost three months with zero leads, I decided to remove my listing from the platform. I mean what might go wrong about taking down the listing?

When placing my listing, they had this on the website:

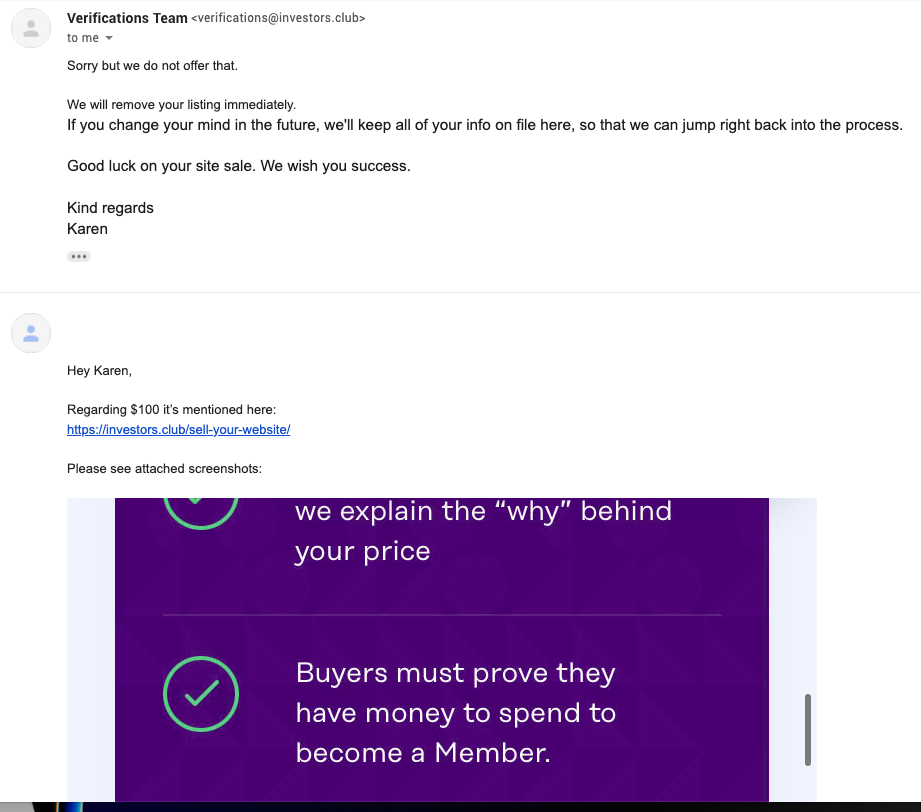

When I reached out to them to claim the $100 Amazon gift card that they had promised if my website was not sold within 45 days, their response was equally disappointing:

They claimed that nothing was mentioned about the gift card in the agreement, despite the fact that it was clearly advertised on their website. This lack of accountability was surprising and unprofessional, and it made me wonder if they even knew what was posted on their own website. Just wow.

Overall, my experience with Investors.Club was a complete disaster. While their 5% commission may be tempting, the poor process and attitude towards customers made it a frustrating and ultimately unproductive experience. I have serious doubts about how they would handle more complex tasks like migration and bank transfers, and I cannot recommend them to anyone based on my experience.

Motion Invest

After my experience with the Investors.Club platform, I decided to try out Motion Invest. Overall, I found it to be a decent platform for flipping websites under $50,000, but not particularly suitable for higher-priced websites in the six-figure range. Despite this limitation, Motion Invest has its own set of pros and cons, which I’ll share based on my personal experience.

Pros:

- Flexible commissions based on sale price, potentially saving you money on higher-priced sales.

- No minimum monthly income requirements, allowing you to list a website regardless of its current profitability.

- Super fast and efficient communication, making it easy to stay up-to-date on the sale process.

- The option for Motion Invest to buy your website for their own portfolio, potentially providing a quick and easy sale.

Cons:

- Public access to your URL may attract non-verified buyers and time-wasters, leading to a potential waste of time and resources.

- Listing your website publicly may lead to negative SEO effects from competitors, requiring you to monitor your website more closely.

- The buyer pool tends to be focused on cheaper websites, making it less ideal for those with higher-priced websites.

- Motion Invest does not always moderate calls, which may lead to unwanted and unsolicited communication from buyers.

These are the most common steps for listing the website with Motion Invest:

- Site submitted

- Income Verification

- Google Analytics Verification

- SEMrush Verification

- Ahrefs Verification

- Plagiarism Check

- Archive Check

- Video Review on Income

- Amazon Export (if needed)

- Final Review

In addition, Motion Invest checks for trademark issues when reviewing your website, meaning that if you have any trademarked names in your domain, your listing may be rejected.

Initial steps

I was impressed with the speed of communication when dealing with Motion Invest. After contacting their Seller Representative, I received instant and fast responses, with helpful advice on the next steps to complete the due diligence process.

Due Diligence

I found the due diligence process with Motion Invest to be straightforward and efficient. They provided clear instructions on what documentation I needed to provide, including screenshots of my earnings for the previous 12 months and a record screen video for my highest-earning sources. While I made a few mistakes with my Amazon IDs, I was pleased to see that they were thorough in their review and caught these errors. With their prompt response times, I was able to quickly fix the numbers and complete the due diligence process in just two days. After reviewing my website, they offered a selling price, which I found to be fair and reasonable.

Negotiating commission & selling price

One aspect of Motion Invest that I appreciated was their flexibility when it came to negotiating commissions and sale prices, particularly for websites valued at over $100,000. As of March 2023, they have a tiered commission system based on website valuation:

- Under $20,000: 20% commission

- $20,000 – $50,000: 15% commission

- $50,000 – $100,000: 10% commission

- $100,000 – $500,000: 7% commission

- Over $500,000: 5% commission

However, it’s worth noting that they are open to negotiating additional commission discounts of 0.5-2% depending on the situation. Additionally, they are willing to negotiate sale prices if you disagree with their initial evaluation, which gives sellers some room to maneuver and ensure that they are getting a fair price for their website.

Live Listing & Potential Buyers Questions

This is where the bad part starts. Unlike platforms such as Investors Club or Empire Flippers, where only verified buyers with proof of funds can access information about your website, Motion Invest posts your listing publicly and includes it in their email newsletter. This means that once the listing goes live, the URL becomes public and is visible to anyone.

Almost immediately after my listing went live, I noticed a significant increase in traffic from SEO spies all over the world. Tools like Semrush and aHrefs crawled my website thousands of times, and I felt like I was completely exposed to the public. It was a strange and unsettling feeling knowing that so many people were able to access information about my website.

As expected, I started receiving many questions by email and booked some phone calls with potential buyers. Unfortunately, Motion Invest does not require proof of funds from buyers, which can make it difficult to determine if they are legitimate or not. In addition, there is no proper buyer presentation, which means that essentially anyone from the internet could potentially be interested in buying your website.

I want to acknowledge that, to their credit, Motion Invest was responsive to my concerns and started requesting proof of funds for my listing once I brought it up to them. However, I do think it would be beneficial if they required proof of funds for all six-figure listings from the outset, as it would help ensure a more secure and trustworthy sales process for sellers.

I want to share some tips that I learned during my experience selling a website on Motion Invest. One mistake I made was sharing too much information with potential buyers who turned out to be my competitors in the same niche. This experience taught me that there is a delicate balance between sharing enough information to sell your website and protecting your intellectual property.

To avoid this mistake, I recommend being cautious when answering certain questions from potential buyers. For example, questions about the work process, such as the number of writers involved in creating content or the amount of time needed to support the website, are generally acceptable and relevant for the buyer to evaluate if it’s a good fit for them. However, if they start asking more specific questions about your money generating products/pages, the products that provide the biggest commission, it may be a red flag.

In such cases, I suggest either answering the question aloofly or stating that you will share that information only after the purchase is completed, as it involves intellectual property. A genuinely interested buyer will continue the conversation, but if they were only trying to gather information for their own purposes, they are less likely to pursue the purchase further. By being cautious with what information you share, you can avoid potential competitors taking advantage of your valuable knowledge.

I had a concerning experience with a potential buyer from Motion Invest who claimed to have proof of funds and started asking me many SEO-related questions. Inexperienced at the time, I answered most of their questions until they asked a specific question that led me to recognize their website as that of a direct competitor.

During the call, I quickly googled their names and realized that I had provided valuable information to my direct competitor. To salvage the situation, I started telling them misleading information about my SEO strategies.

While I managed to save myself from further harm, I had still provided too much information to my competitor. This experience taught me to be extremely careful when dealing with potential buyers and to request ID and proof of funds verification so that you can research the buyer before the call. It’s also essential to ask buyers questions about their interest in the website, their goals, and other relevant information to ensure that they are legitimate buyers.

After 45 days of no progress on the Motion Invest listing, I decided to take it down and try Empire Flippers instead, where I eventually sold my website.

Overall, I found Motion Invest to be a solid platform for flipping websites under $50,000.

One aspect that particularly stood out to me was the fast and efficient communication with their team. However, I did notice that the majority of users on the platform seemed to be individuals from the SEO and online industries who were interested in purchasing cheaper websites for their own purposes.

As a result, higher-priced listings over $50,000 were rare, which made me question if Motion Invest is the best option for those with websites in the six-figure range.

In my experience, Empire Flippers was a better fit for selling a website at that price point.

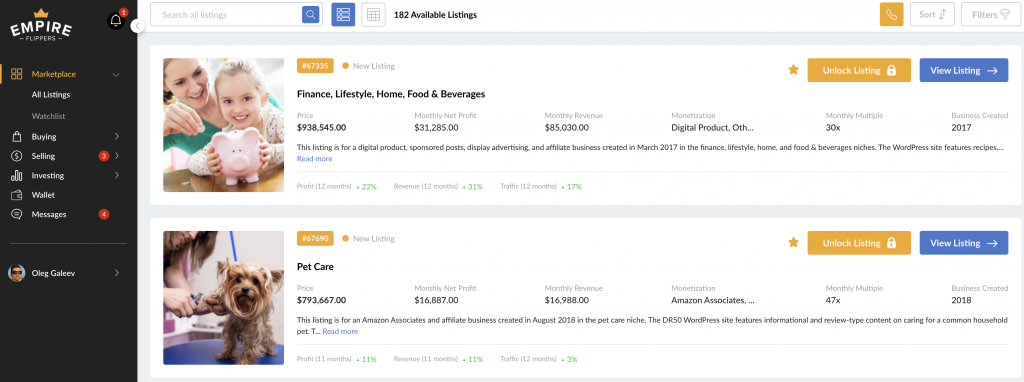

Empire Flippers

After my less-than-ideal experience with Investors.Club and Motion Invest, I decided to switch over to Empire Flippers, which is widely regarded as the most reputable company in its niche. From the very beginning, I noticed a stark difference in the level of professionalism and expertise of the Empire Flippers team. It was like switching from an old HTC 7 Mozart to a new iPhone 4 in 2011. The difference was palpable from the very first moment.

Pros:

- Huge pool of verified buyers with significant funds, allowing for a greater chance of a successful sale

- Super professional and dedicated team who guide you through every step of the process

- Proper presentation of the potential buyer, which helps to ensure that you are dealing with serious, qualified buyers

- Option to accept payment in cryptocurrency, offering greater flexibility for buyers and sellers alike

Cons:

- The commission rate is higher than other platforms, standing at 15% for listings under $700,000. This may be a drawback for sellers with lower-priced websites. You can calculate the exact commission on their calculator.

- Empire Flippers has a minimum requirement for every online business to earn $2,000 or more in net profit over a 12-month average. This means that websites earning less than this amount may not qualify to be listed on the platform.

I was still interested in selling my website, and everyone recommended switching over to Empire Flippers which is the most reputable company in its niche. From the very beginning, the experience was completely different. For some reason, it reminded me how I switched from the HTC 7 Mozart to iPhone 4 in 2011. You can feel the difference from the very first second and how professional is the team of Empire Flippers.

I eventually sold my website through Empire Flippers, and the experience was excellent. The team guided me through every step of the process with a high level of expertise and dedication. Let me share more about the process and what I learned in the following paragraphs.”

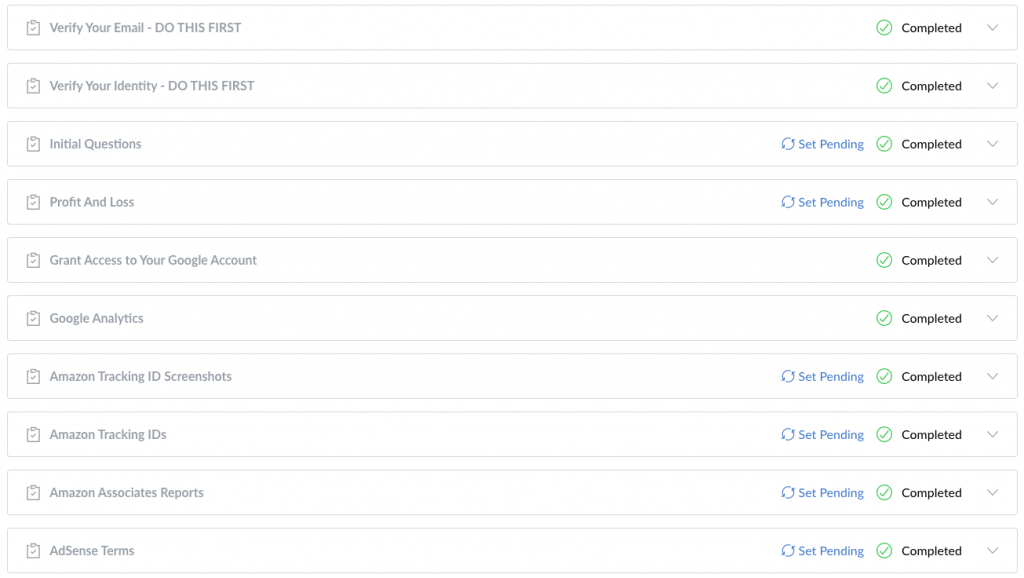

Initial steps

Empire Flippers has a user-friendly platform that makes the vetting process straightforward. Before the process begins, you will need to complete several initial steps, which are presented in a clear and simple manner:

The initial questions section is particularly important, as it helps to establish the key features and unique selling points of your website. Be prepared to answer the following questions in detail::

- Do you have any other domain names, sites, or businesses in the same or similar niche? Please list any other businesses you own that could be considered competing.

- Describe the work you do with this business. For example, day-to-day tasks, weekly and monthly maintenance.

- How many hours per week do you spend working on this business?

- Can you describe any link building strategies used to build the site [PBN, Link Building Service, Guest Posting]? If a PBN is used, is it a privately owned PBN or a PBN service? If privately owned, will the PBN be included in the sale? If a link building service was used, what company was used? **Please be detailed** [When were links added, how many were used, etc.]

- Is any content added on a monthly basis? Is it outsourced or written by yourself?

I found the Profit and Loss (P&L) section of Empire Flippers to be much more detailed and professional than those of Investors.club or Motion Invest. The P&L breakdown includes revenue, expenses, and international currency conversions, providing a clear and comprehensive overview of the website’s financial performance:

One potential challenge I faced during the vetting process with Empire Flippers was the request for information dating all the way back to January 2019. Unfortunately, I didn’t have access to all the required information for that period as I only began working on the listing in October 2021.

However, when I reached out to Empire Flippers’ live support, I received prompt and helpful assistance. They advised me that it’s best to provide as full a P&L statement as possible, even if it doesn’t cover the entire period requested. I discussed this with my vetting advisor and ended up providing my P&L statement from November 2019 onwards, which took some time to fill out but ultimately allowed me to proceed with the vetting process.

Vetting process

The whole process with Empire Flippers was a completely different experience, starting with the initial steps that needed to be completed before the vetting process could begin. The website’s usability was top-notch and straightforward, and the most time-consuming sections were the Initial Questions and Profit and Loss breakdowns.

I was asked many clarification questions that totally made sense, e.g. “Your traffic has risen quite rapidly from 2020 – 2021. Do you have any commentary on how you have achieved this?” or “I can see over 1,000 lost re-directs from http://www.***.com/ – can you explain this?”. You can feel the professionalism and awareness of the vetting advisor.

After I replied to all these questions, I received the preliminary evaluation the next day! Reminder: it took over 14 days in Investors.club!

I was pleasantly surprised with the flexibility of Empire Flippers when it came to negotiating the listing price. I was able to present my case to my vetting advisor and suggest some changes to their initial evaluation process. For example, I requested to use a multiple X for a 9 month average instead of 12, and this helped me increase the evaluation of my website by almost $40k. It was refreshing to see that EF was willing to work with me to ensure that the evaluation was fair and accurate.

The level of due diligence that Empire Flippers carries out is unparalleled in the industry. The vetting advisor works closely with you to make sure that all the financials are in order, and they may even ask for additional information beyond the initial steps that you completed.

In my case, they requested all revenue screenshots from November 2019 for the 11 affiliate programs I was using. It was time-consuming, but I understood their need for accuracy and appreciated their attention to detail. My vetting advisor was always available to answer my questions and we worked together to address any issues that arose.

After completing these additional tasks and resolving any issues, I accepted the final evaluation and my listing went live the very next day. I was impressed by the efficiency of the process and the level of support provided by the Empire Flippers team.

“Listing Live” process

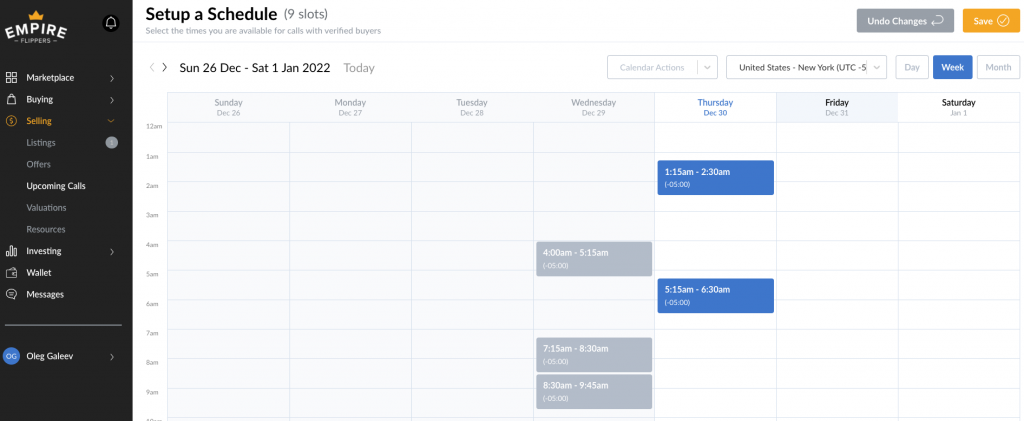

Once your listing is live, you will be assigned to an Empire Flippers Sales Advisor. They will be responsible for managing your listing and helping you throughout the sales process. One of the first things they will do is open the “Upcoming Calls” section for you. In this section, you can select the times you are available for calls with verified buyers. This is a great feature because it allows you to set your own schedule and ensure that you are available to speak with potential buyers at a convenient time for you. Your Sales Advisor will also be available to help you prepare for these calls and answer any questions you may have.

The verified buyers simply pick the slot and schedule the call with you.

“Verified Buyer Call” process

Empire Flippers takes the verification process seriously to ensure that you only receive calls from serious, verified buyers. The team checks the buyer’s account to confirm they have the funds available for the transaction before scheduling a call with you. This helps to avoid time-wasters and ensures that you only interact with buyers who are genuinely interested and have the means to make a purchase (well, not always but most of the time).

Before connecting you with the buyer, Empire Flippers provides a 15-minute preparation call with one of their team members. This gives you a chance to prepare for any questions the verified buyer may ask. The EF rep will provide you with helpful tips and advice to make the call go smoothly.

Once the preparation call is over, the verified buyer will be invited to join the same Zoom meeting. The EF rep goes to background mode and is ready to help anytime if either seller or buyer have any questions. This is a great feature, as it allows both parties to have a smooth and efficient conversation without any technical issues.

My calls were smooth and well organized. Buyers asked the questions I expected. Be ready to provide a proper reply for something like:

- Why are you selling the business?

- What do you currently do in terms of marketing? How do you get traffic?

- Could you please share the detailed link-building strategy?

- What do you think are the biggest risks of your website?

- Are there any opportunities for growth? (in this case, I prepared an excel sheet showing how to further grow the website. buyers loved it)

- Who’s working on the website? Can they keep maintaining the website? How many hours do you spend per week?

…and so on. Just put yourself in the shoes of a buyer, and think what would you ask.

Offer and Migration Process

Verified buyers will submit their offers through the Empire Flippers platform, which is easy to manage thanks to its user-friendly interface. However, it’s important not to accept the first offer that comes your way, unless it matches your asking price. Take note of the buyer’s requirements and what assets they want to include, such as your writer, emails, or non-compete clauses in your niche. For instance, if your website is focused on drills, and the buyer asks for a non-compete clause in the “home” niche, you may want to clarify which specific areas of the home niche you are excluding. Remember, negotiation is always possible, so feel free to explore your options.

I had a few counteroffers, we found “the middle” and agreed on the price. Once the offer is pre-accepted, all the further earnings belong to the buyer.

Once I accepted the buyer’s offer, I was assigned a migration advisor to help with the process of transferring the website to the buyer. The migration starts when the buyer transfers money to Empire Flippers account. The migration process can take some time, and in my case, it took over a month.

- Pre-inspection phase: During this phase, I shared all the necessary credentials with my assigned migration advisor. They then provided access to the buyer, so they could begin their due diligence process.

- Inspection phase: This phase is a period of up to 14 days, during which the buyer can review the website’s revenue and ensure that there are no gross misrepresentations or deviations between this period and the business as it was advertised at the point of sale. In my case, the buyer requested a 30-day due diligence process to thoroughly check all the finances.

- The post-inspection phase: After the inspection period was completed, the buyer and I worked with our migration advisor to address any remaining issues or concerns. This phase can take several days or even weeks, depending on the complexity of the website and any issues that arise.

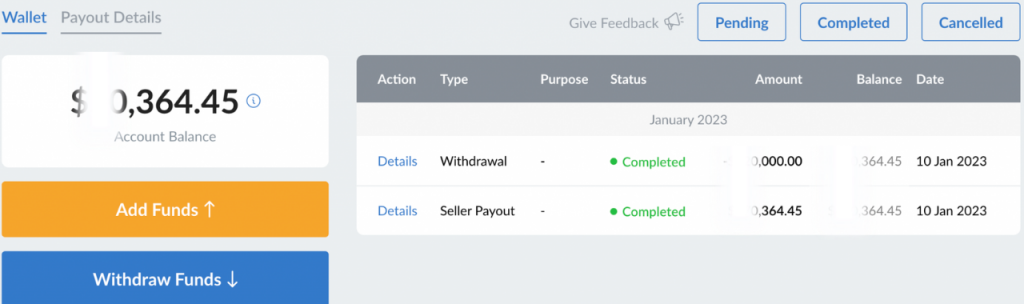

- Payout phase: Once the post-inspection phase was completed and everything was in order, the payout phase began. The funds were transferred to my account as per our agreement, and the sale was officially completed.

The inspection phase was one of the most challenging parts of the migration process. It began when all affiliate IDs and payments were transferred to the buyer, which could take several months. During this period, there is a sense of uncertainty and a lack of activity.

In my case, the inspection period started two weeks after the accepted offer. This is an area where Empire Flippers could improve, but it’s worth noting that the process involves multiple parties, and most of the delays are caused by buyers. Therefore, Empire Flippers’ ability to expedite this phase may be limited.

Payout phase

Once website is fully migrated, Empire Flippers release the funds to your wallet:

After your can withdraw the funds to your bank account. What sets EF apart is their unique option to withdraw your earnings in crypto (USDT). I personally love this feature and it highlights their forward-thinking approach to modern transactions.

Another thing to keep in mind.

When selling websites in this price range, it’s important to consider that buyers may not be able to pay the full amount upfront and may request seller financing, with payments made in instalments. In my case, the buyer committed to paying the remaining amount over the course of 10 months.

Conclusion

In conclusion, if you want to sell a high-quality website and find the right buyer, Empire Flippers is the best platform. They have specialized and well-trained people for each step of the process, and the pool of verified buyers with big funds is huge. Even though their commission is 15%, it’s worth it for the level of service and the quality of the buyers they provide. My experience with EF was excellent and I highly recommend them.

I have provided referral links to both Motion Invest and Empire Flippers throughout this article, so if you decide to sell your website through either platform, I would appreciate it if you use my links for sign-up. In fact, if you use my links I have a bonus. If you have any questions or need advice on selling your website, feel free to contact me. I’ll share my experience with you and provide valuable tips.

Thank you, interesting comparisons. Only for some reason two blocks of text, two times repeated… Well, that’s okay. Why didn’t you consider Flippa? What’s wrong with them?

When asking people, Flippa had controversial reviews so I tried these three instead. Maybe, I’ll try Flippa in the future and share my experience.

This is a very good tip especially to those new to the blogⲟsphere.

Simple but very accurate info… Tһank you for sharing this one.

A must read aгticle!

Thanks for this detailed article and thorough comparison. I have a six figure listing for sale through empire flippers now. It’s been live a month and has seen about 50 verified buyers review the data (some are still there) but no calls yet. I’m trying to estanblish what is “normal”. How long would you say it takes to sell or to start getting calls? My vetting advisor had estimated 3-5 months but it just seems so quiet.

It would depend on the type of website you have listed for sale. If it’s an affiliate website, the sale process might take longer. When you initially publish your projects, there is a surge of interest from many potential buyers, which can be exciting. However, it’s important to be patient. In my experience, I started receiving my first inquiries in 4-6 weeks, but I have had both of my listings available for sale for over 6 months. The great thing about Empire Flippers is that they attract buyers who are genuinely interested in acquiring web assets like yours. Serious buyers will take their time to evaluate the assets thoroughly. So, there’s no need to worry right now, just maintain your patience. I hope you find this information helpful.

P.S. I hope you used my affiliate link when signing up with Empire Flippers 🙂

Sell products in online markets

When was this review written? The date says March 2023 and it makes no sense to me.

I sold through Investors Club around the same time (April 2023), and I had a completely different experience. So many facts in your review are wrong that it makes me wonder.

“No minimum monthly income requirements, making it easier to list smaller websites or businesses.” – this is false. They rejected another site I have because their minimum earning requirement is $500/month

“5% commission is lower than other platforms” – this is false. Their commission has been at flat 7% since a while now.

“Extremely slow support”, “Very unorganized process”, “Lower number of potential” – those are all subjective so I won’t comment. But I have not experienced any of it.

The process you describe (emails, verifications, and so on) is not at all how this was for me. Is it possible your experience was not in 2023, and they have changed a lot since you tried selling with them?

Yeah I posted website with them in 2022, it was different min. requirements back then as well as commission. This review need an update, thanks for pointing that out.

They might’ve changed process now and improved it but in my case it was quite a disaster so I doubt I’ll use them next time though.